Workday Financial Management Made Better with Optimizations

S ome of the largest and most well-respected businesses in the world trust Workday Financial Management as their enterprise solution. With Workday, businesses can reduce costs, improve accuracy, and increase efficiency. The software can automate accounting, reporting, budgeting, forecasting, accounts payable and receivable, and payment processing.

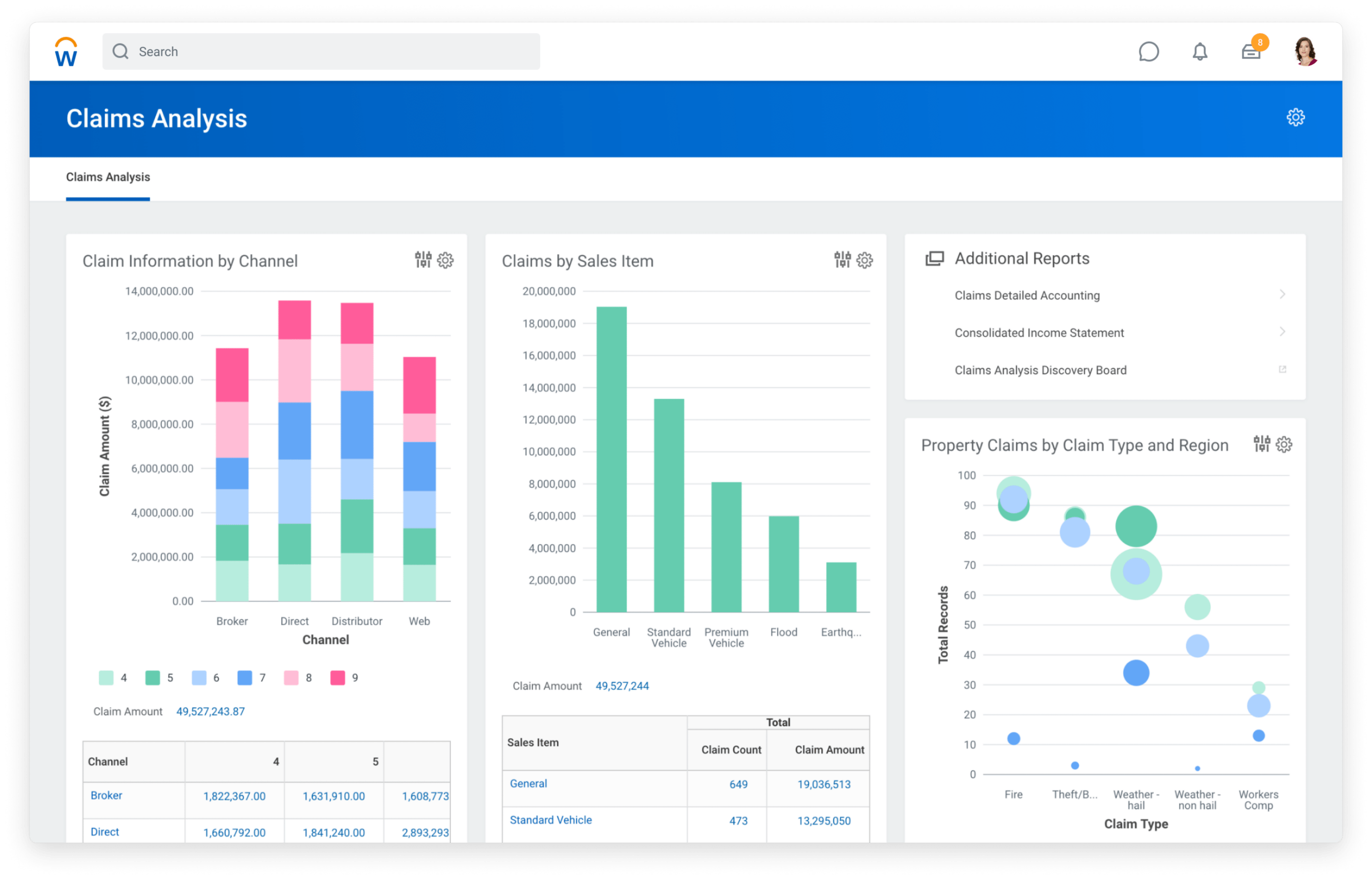

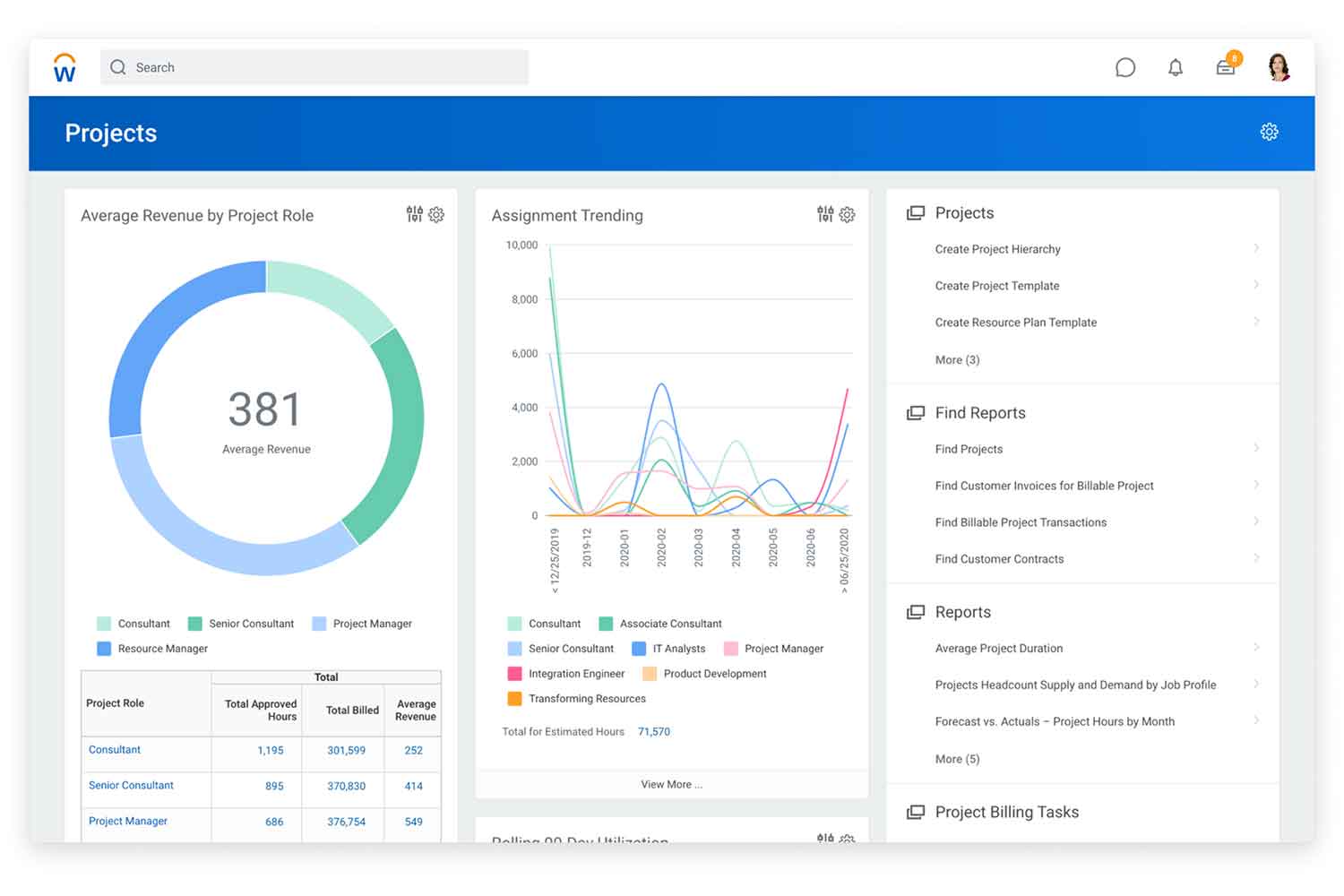

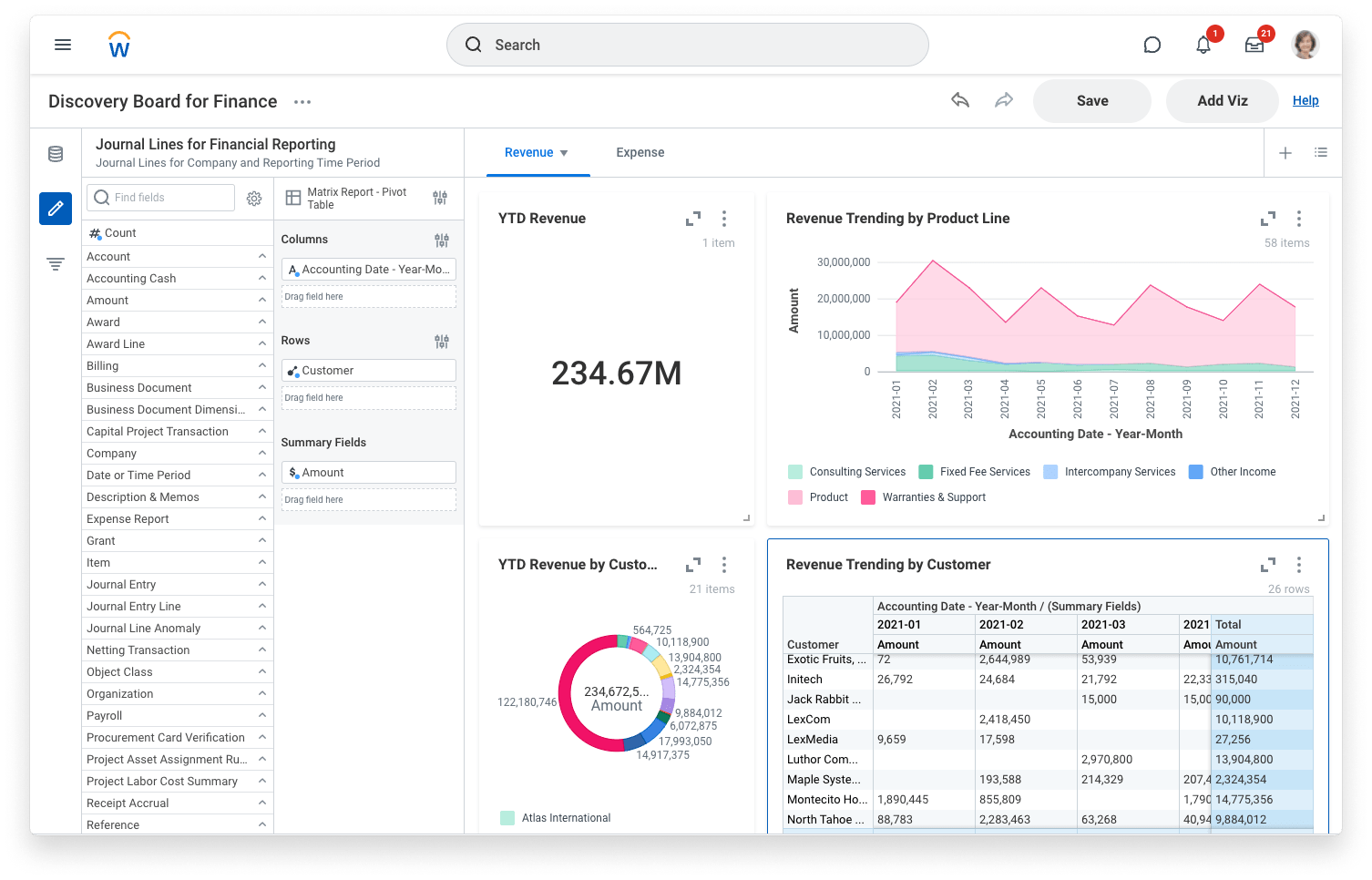

These tools give businesses greater visibility into their financial data, allowing them to make more informed decisions. With comprehensive, real-time data, businesses can identify areas where to cut costs or potentially increase revenue. Workday includes many advanced tools such as:

- automated invoicing and payroll tools

- accounts payable and receivable software to track finances

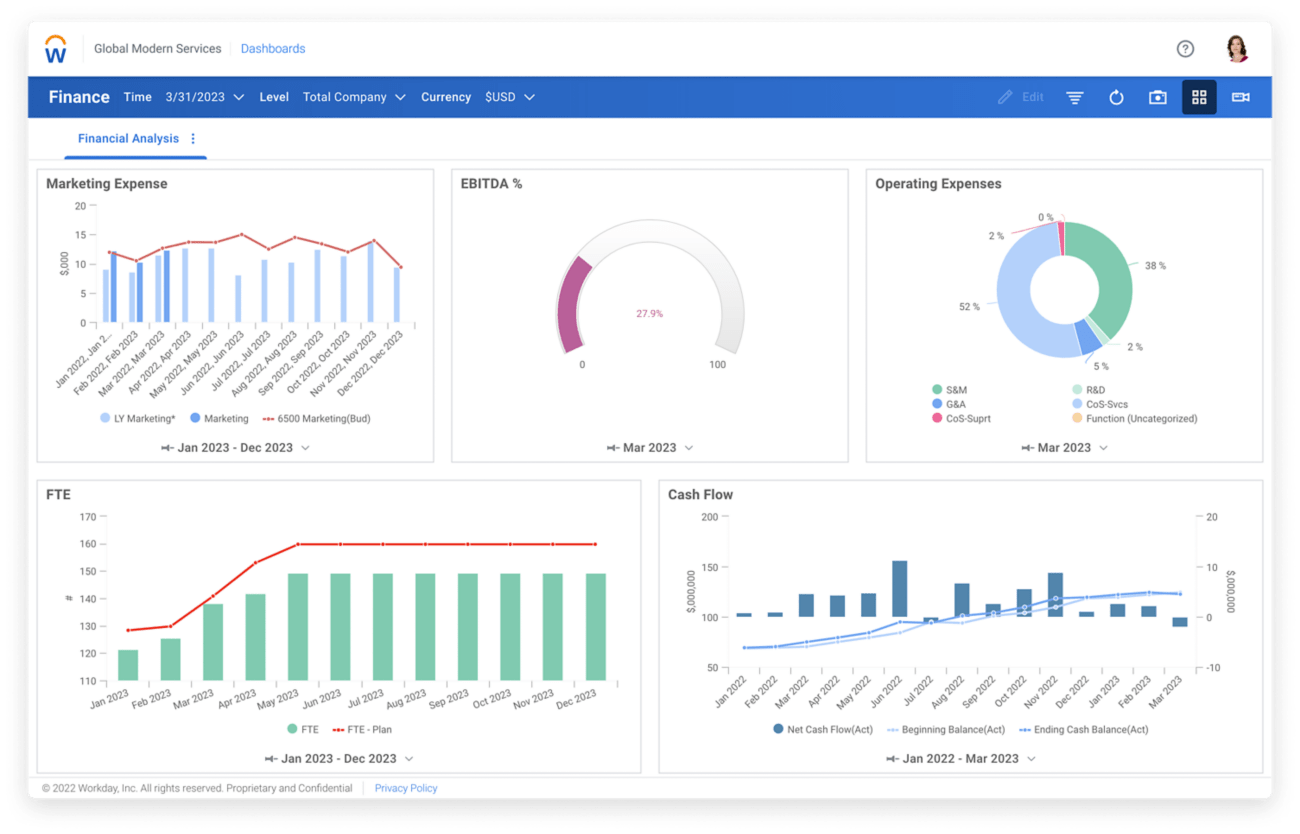

- budgeting and forecasting dashboards for business planning

If you’re looking for business software that can streamline and automate your financial management processes, you should know that Workday is an industry leader. This software helps businesses amplify operational strengths, and, when backed by a post-production support partner, it’s easy to get the maximum value from Workday’s native financial management functions.

The Benefits of Workday Financial Management for Your Business

Workday’s financial management features help businesses save time and resources because they automate key processes and bring visibility to data management. Workday’s tools do the following:

- Gain a complete and accurate picture of financial processes

- Give executives and business managers the tools they need to assess relevant, contextual financial insights

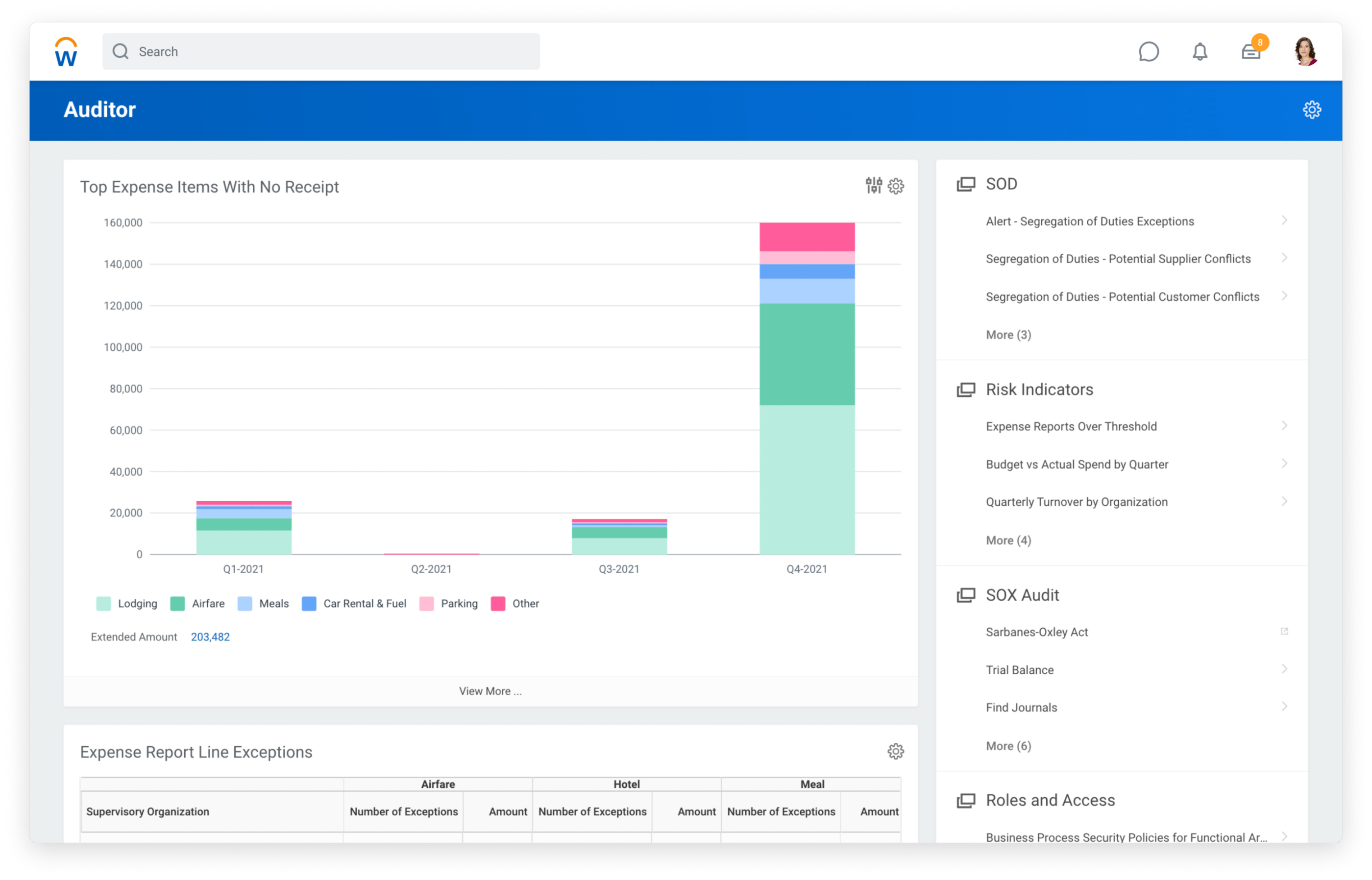

- Provide best-in-class and always-on audit capabilities

- Support organizational process improvements and report changes without business disruption

- Provide a consistent and easy-to-use interface for all users, including employees, managers, executives, and auditors

These Workday financial management features can be configured to meet the specific needs of the business, and they can be accessed in real time from anywhere with an internet connection. Workday’s financial frameworks allow customers to meet multinational requirements without hard-coded configurations. It can even help with some of the critical challenges for HR leadership.

Enhance Payment Processing and Budgeting Efficiency

For example, by tracking accounts payable and receivable, businesses can avoid costly late fees. The software’s invoicing and payroll tools can automate these processes so businesses don’t have to spend valuable time and resources on manual tasks.

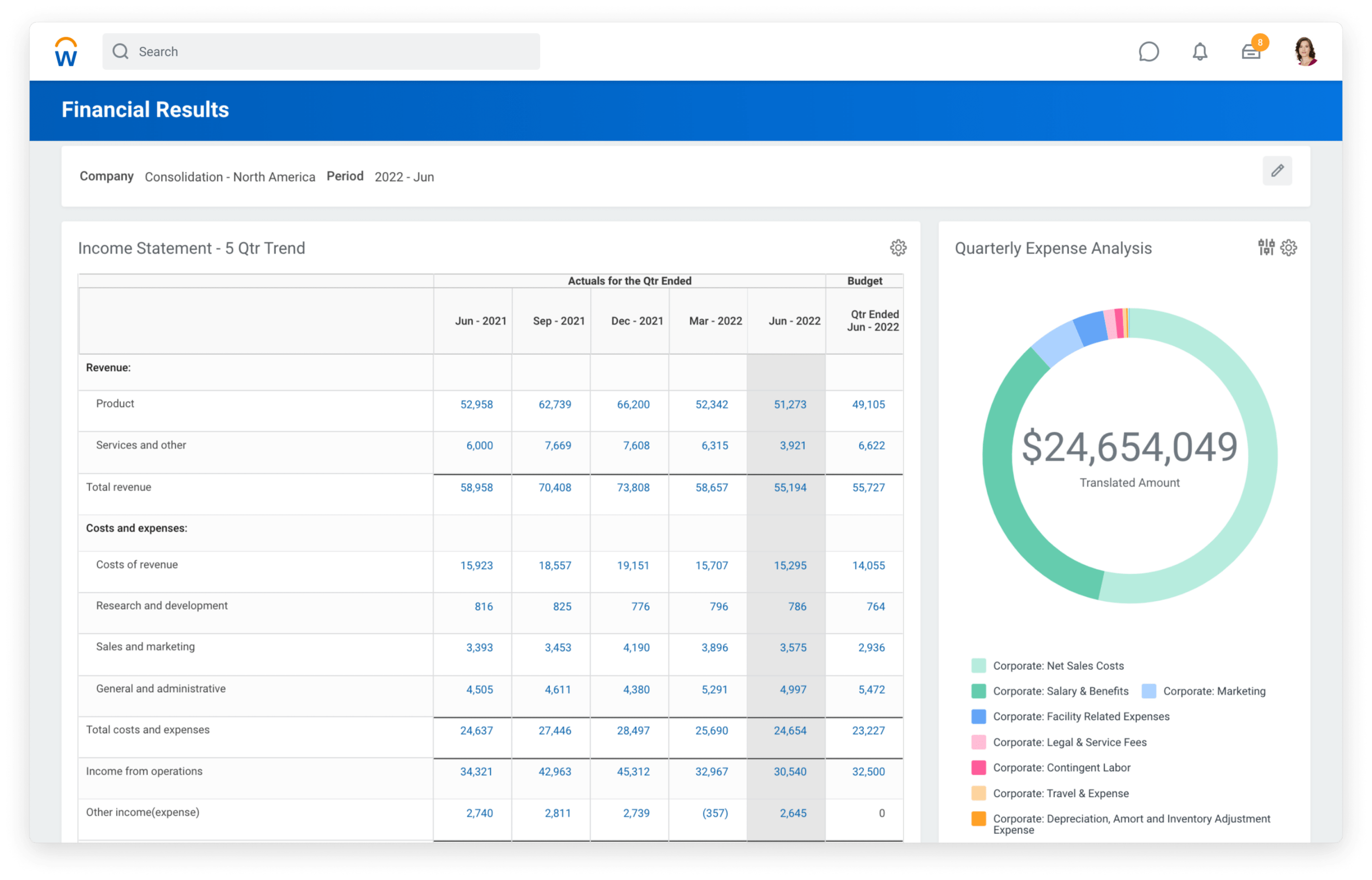

Workday Financial Management automates accounting and reporting, and it offers advanced budgeting and forecasting capabilities. These tools provide businesses with real-time data on their financial performance so they can plan for the future.

Workday helps financial planners make better decisions because it collects data from transactions and creates reports quickly. It uses a special data model that can look at the business from many different angles and lets users drill into the details of their reports.

When businesses streamline budgeting and forecasting, they can improve the company’s ability to make informed decisions and the forecasting features help businesses stay ahead of market trends. With real-time data at their fingertips, businesses can turn data into action.

Reduce Costs and Improve Accuracy

Workday Financial Management helps businesses operate with more efficiency and at a lower cost because it leverages machine learning to detect problems and make recommendations. It also helps businesses keep track of compliance concerns reducing the fire drills when it comes time for audits.

The automated accounts receivable feature ensures that businesses are paid the correct amounts, and any discrepancies are efficiently identified and resolved. The automated accounts payable and receivable features help businesses identify and resolve discrepancies to help you monitor your cash flow.

ERPA Makes Workday Financial Management Optimization Easy

Workday’s financial management features enhance efficiency and accuracy by automating key processes, but launching your Workday implementation is just the first step. Post-production support partners like ERPA can take these essential features and configure them to each business’s specific ecosystem, such as:

- A focus on the business’s needs

- Diagnostics that offer a full review of day-to-day operations

- Tailored documentation for your custom integration

- Deliverable prioritization to best align with capabilities

- Future state planning and building room to grow

These features, professionally optimized for your organization, offer a quick way to enhance current deployments, reduce errors and redundancies, and establish a sustainable structure for the future.

Financial operations, management, and accountability are more important now than ever. That’s why having a Workday post-production support partner on your side is so critical to success.

ERPA is a leading provider of Workday solutions, and we help businesses optimize their use of the software. We offer a variety of services such as implementation, configuration, and training to reap the benefits of their investment in Workday. Additionally, ERPA’s team of experts can assist with Workday Optimizations to fine-tune the software so it meets the specific needs of an organization.

If you’d like to learn more about how Workday and ERPA can help your business, contact us with questions and let us help you optimize your Workday solution.